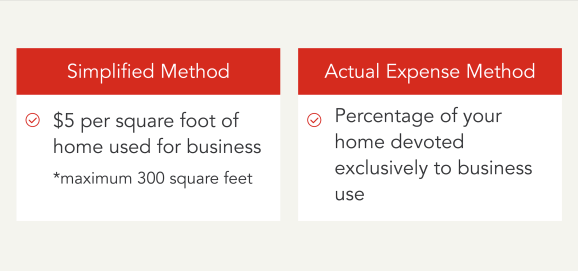

Deducting Home Office Expenses 2024 – Key Takeaways – Can You Take the Home Office Deduction? Many people whose jobs became remote during the COVID-19 pandemic are still working from home. Some work entirely from home or on a hybrid . Any home purchase or refinance comes with a long list of fees. The trick is figuring out which ones are tax deductible and which ones aren’t. .

Deducting Home Office Expenses 2024

Source : www.freshbooks.comHome Office Deduction: How It Works, Who Can Take It NerdWallet

Source : www.nerdwallet.comHome Office Tax Deduction 2024 Blog Akaunting

Source : akaunting.comHome Office Deduction: How It Works, Who Can Take It NerdWallet

Source : www.nerdwallet.comSmall Business Tax Deductions Checklist 2024 Blog Akaunting

Source : akaunting.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comHow to file your taxes for free this season

Source : www.cnbc.comDo I Qualify for the Home Office Deduction? Intuit TurboTax Blog

Source : blog.turbotax.intuit.comHow to file your taxes for free this season

Source : www.cnbc.comKeystone CPA, Inc. | Fullerton CA

Source : www.facebook.comDeducting Home Office Expenses 2024 25 Small Business Tax Deductions (2024): Taxpayers can take advantage of numerous tax deductions, also known as tax write-offs, to lower their tax bill or receive a refund from the IRS come tax season. Learn More: Trump-Era Tax . The flat-rate home-office expense deduction is no longer available for 2023. But eligible employees who work from home can still claim a deduction. .

]]>